Reshoring Reality Check: Robots, Tariffs, and the Future of US Manufacturing

The Reshoring Narrative – Is it What We Think?

We've all heard the buzz: "Manufacturing is coming back to America!" Big announcements, impressive investment numbers, and promises of revitalized industry. But let's peel back the layers. In an age dominated by technology and robotics, what does reshoring really mean for the American worker and consumer?

Where will jobs be created? How long will they last? Which ones will never come back?

The Automation Factor: Where Are the Jobs?

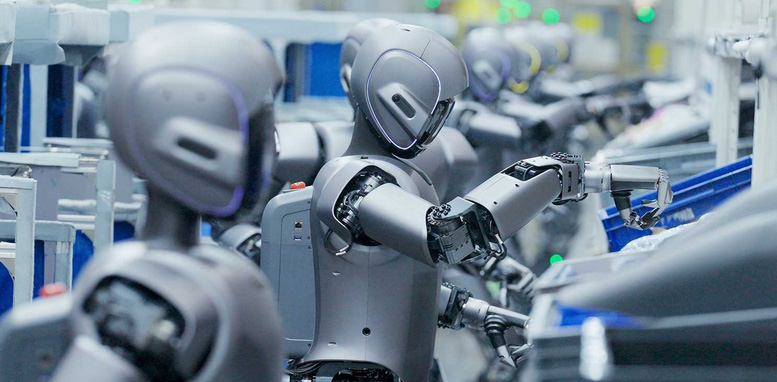

The reality is that many companies "reshoring" are primarily investing in automation. Think cutting-edge robotics, AI-driven processes, and streamlined production lines. While these investments are undeniably impressive, they often translate to fewer human jobs on the factory floor. Companies like Apple and Taiwan Semiconductor, with their massive China-based facilities, are prime examples. These companies may be pledging investments but there is no detail on how and where that money be invested and what incentives have been accorded to them.

These investments will obviously create construction jobs initially, but long-term, the staffing needs of these facilities are a fraction of what they were in the manufacturing heyday of the 20th century. Let’s see the ratio of parking lot size related to the building footprint.

It is estimated that 14% of jobs will be replaced with AI technology by 2030 (source: McKinsey) or about 375 million will be forced to change their careers. What’s more, AI technology is targeting middle earning white collar jobs.

The 15 fastest declining jobs (in percentage terms) by 2030, according to the World Economic Forum’s Future of Jobs Report:

- Postal service clerks

- Bank tellers and related clerks

- Data entry clerks

- Cashiers and ticket clerks

- Administrative assistants and executive secretaries

- Printing and related trade workers

- Accounting, bookkeeping and payroll clerks

- Material-recording and stock-keeping clerks

- Transportation attendants and conductors

- Door-to-door sales workers, news and street vendors, and related workers

- Graphic designers

- Claims adjusters, examiners and investigators

- Legal officials

- Legal secretaries

- Telemarketers

These are many of the same groups impacted by the introduction of the PC in the workplace in the 1990’s.

The Labor Cost Conundrum: Inflation and Tariffs.

The core challenge for US and many European manufacturers is high wages and related labor costs like insurance and compliance. Understandably, workers need fair wages to keep pace with rising inflation in their country. But here's the twist: most other countries don’t experience accelerated inflation driven by tariffs and therefore wages aren’t impacted. This also means costs of goods and services remain generally the same.

Employee carrying costs like taxes and insurance forced onto companies by government regulation on positions still held by humans already squeeze margins in western societies or simply make them uncompetitive. Awhile the exact same good or service can be created in a low-cost geography. These are easily sold domestically or exported to countries where tariffs don’t exist and sold at a competitive price.

Reshoring jobs to these high carrying cost countries will be difficult since products made would have higher costs and would need to be sold domestically only.

The Mainstream Production Dilemma: Are We Priced Out?

For mainstream consumer goods, reshoring with traditional labor-intensive methods is simply too expensive. Consumers won't pay the resulting premium. This leads to reduced sales, product discontinuation, and fewer choices for shoppers.

This is basic logic here. It means a new set of tools, that new riding lawn mower, or maybe a new set of curtains will now cost at least 25% (probably more) in material cost over what it did prior to tariff implementation. Depending on where different parts are made and then assembled. However, if it’s a finished product being imported it will command that same percentage increase on the final value instead of on the individual components. Either way, the consumer pays more. A consumer purchase can only follow a wage increase.

Again, we are not talking about “putting a tariff on China” so much as we are putting a tariff on domestic importers. This is intended to be direct pressure on importers who choose products from the targeted country.

The Squeeze on Resellers: Online and Local.

Online resellers relying on drop-shipping from China, local shops, and mass retailers sourcing from highly tariffed countries are facing a precarious situation. They risk being priced out of the market, unable to offer products at competitive prices.

Big box retailers like Wall-Mart, sellers on Amazon and other marketplaces, even local shops will need to raise prices in order to maintain even a slim profit margin. Buying domestic products sounds great only if the consumer has the spare change to spend the extra money. Necessities become options and alternative solutions are sought as traditional methods of doing things come back into vogue.

Global Markets: A World Beyond the US.

So, let’s get around all this gloom and doom.

We should not forget that the world doesn't revolve around the US. Manufacturers in tariff-affected countries are actively seeking new markets. They're not waiting for a grand American return. It's a touch of arrogance to assume they will.

Small businesses and entrepreneurs might look to markets outside the US. There are many obvious foreign markets where English is either a primary country or a standard accepted language. People are people. They have similar wants and needs as anyone else anywhere else. It’s a misconception to think another country’s people don’t.

There may be a pot of gold at the end of that foreign market rainbow.

A Call to Action: Adapt or Be Left Behind.

This article is intended to be a wake-up call. We need to be realistic about the future of manufacturing. Technology is reshaping the landscape, and businesses must adapt.

- For Businesses: Diversify your supply chains. Explore alternative sourcing options. Embrace automation strategically. And most importantly, stay agile.

- For Consumers: Be prepared for potential shifts in product availability and pricing. Support local businesses where possible.

- For Policy Makers: Let's have an honest conversation about the long-term impact of tariffs and automation on the American workforce.

Let's Discuss:

What are your thoughts on reshoring in the age of robotics? Are we creating jobs or simply automating them away? How can businesses and consumers navigate this changing landscape? Share your insights and let's keep this conversation going. Don't get caught without options.